Beauty Health: Skincare Today & Alpha Tomorrow (NASDAQ:SKIN)

Mizina/iStock via Getty Illustrations or photos

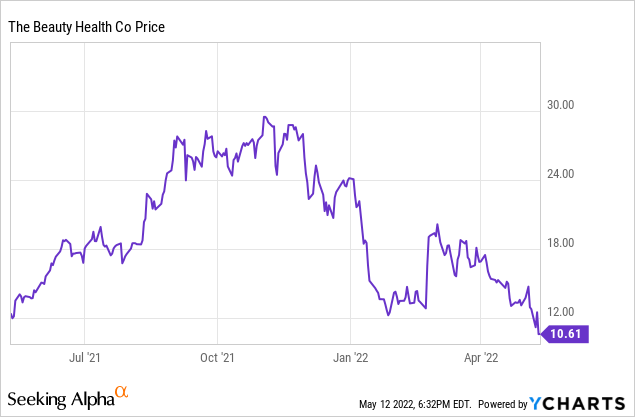

Splendor Well being (NASDAQ:Skin) emerged from the pandemic with content momentum driving it as world wide need for HydraFacial, its patented non-invasive skincare procedure, ramped up. This intended the firm’s run to a 52-week superior of $30.17 experienced authentic legs as it was crafted on the back of seem financials, most notably the generation of beneficial adjusted EBITDA.

With the rate of its common shares dropping by 64.8{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269} from these highs, Elegance Wellbeing has since grow to be section of the wonderful collapse of progress shares. What does this indicate for a company that carries on to mature its HydraFacial footprint? With the significant-stop facial treatment answer now available in about 90 nations and the development of a new shipping and delivery technique, Splendor Well being is signalling to more prudent lengthy-expression shareholders that its present-day inventory price malaise is very likely temporary.

Solid First Quarter Effects Drive Upward Steerage Revision

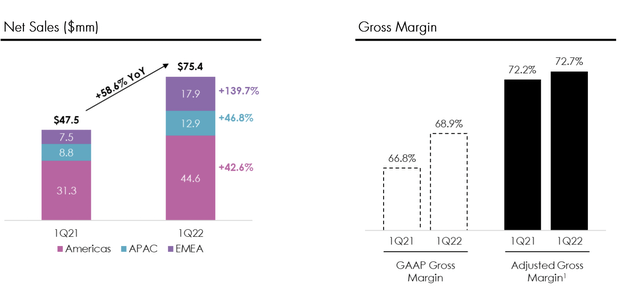

The corporation claimed earnings for its fiscal 2022 initial quarter immediately after the marketplace shut on Tuesday. This saw earnings arrive in at $75.42 million, a 58.6{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269} increase from the similar calendar year-ago quarter and a $7.27 million conquer on consensus estimates. Beauty Well being marketed 1,849 supply systems all through the quarter to increase its set up base to 21,719 with an regular marketing value of $21,462.

Beauty Health and fitness

Gross sales in EMEA noticed the major share raise at 139.7{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269}. Gross margins also grew on equally a GAAP and adjusted foundation with the latter achieving 72.7{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269}, up 50 foundation details from the similar yr-back quarter.

On the other hand, altered EBITDA was down to $2.2 million from $7 million in the year-in the past time period owing to what administration explained as ongoing headwinds from global offer chain problems and inflationary pressures. This noticed altered EBITDA margins slide materially to 2.9{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269} from 14.8{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269}. The firm, however, expects bigger shipping prices to go on to weigh down on margins through 2022. Although this is not welcome news for Splendor Health and fitness bulls, there was a salve with the business rising its fiscal 2022 income steerage. Net revenue are now predicted to be in the vary of $330 million to $340 million, up from the preceding outlook for $320 million to $330 million. The company also reaffirmed its steerage for altered EBITDA of not fewer than $50 million all through the yr.

The instant adverse reaction of the frequent shares came on the back of 3 brokerages decreasing their selling price targets on the business. Most notably was Piper Sandler which flagged weakening GDP and buyer sentiment across the globe as a rationale to reduce its many on the business to 7x estimated fiscal 2023 sales compared to 9x formerly. This brought the price tag concentrate on down to $24 from $26.

Applying the very low conclusion of Beauty Health’s fiscal 2022 profits guidance, the company now trades on a 4.85x product sales multiple with its market cap at $1.60 billion. This presents home for upside if the several rises to Piper’s already lowered a number of. Further, Attractiveness Wellbeing held a product $859.2 million in dollars and equivalents on its balance sheet, generally from a $750 million 1.25{614fc3c32b079590f5b6a33afe99f1781dd92265c15f5c1e8aa861cac1d0c269} convertible notice thanks in 2026. It also retained an undrawn revolving credit rating facility of $50 million which the organization states will give them with adaptability for long run acquisitions.

Elegance Well being

At the main of Magnificence Health’s sector technique is its master approach, a string of bold statements to supply on innovation, make investments in its brand, and nurture direct shopper interactions. The enterprise also expects acquisitions to engage in a considerable function to make its method transfer a lot quicker. The most salient advancement on this was the March launch of Syndeo, a new digitally related HydraFacial shipping and delivery system. This platform presents a major know-how up grade from the current HydraFacial delivery technique as it brings details collection abilities for a personalized and connected practical experience. I count on the new technique will assist push revenue from Natural beauty Health’s present consumer foundation as nicely as new buyers coming into the HydraFacial community.

Skincare These days And Alpha Tomorrow

Beauty Overall health is a victim of a excellent crash whose chapters are nevertheless remaining composed as central financial institutions close to the entire world shift to aggressively crush runaway inflation. The crash now supersedes the peak panic we had again in March 2020 when the globe very practically shut by itself down and with it the enterprise designs of organizations like Elegance Health and fitness. The target now shifts to the extended-expression likely of a substantial-high quality firm beset by limited-phrase headwinds to its business enterprise design. The fundamentals subject and Elegance Well being has proved alone to be a prudently run firm ready to improve income whilst even now creating favourable modified EBITDA. The firm’s world expansion will assist to sustain its profits ramp and diversify its income foundation. This is primarily accurate as Europe continues to see rigorous gross sales advancement. In this regard, this was an outstanding quarter of development as the enterprise executed masterfully on its master plan.